Understanding Medi‑Cal Estate Recovery in 2026

Understanding Medi‑Cal Estate Recovery in 2026 Why this still matters — and how families and individuals in California should plan ahead When many people hear about Medi-Cal, they think of health coverage for low-income individuals. What’s less noticed is the...

Protect Your Home and Savings from Medi-Cal Estate Recovery Before the 2026 Rule Changes

Protect Your Home and Savings from Medi-Cal Estate Recovery Before the 2026 Rule Changes Why this still matters — and how families and individuals in California can protect their assets The clock is ticking for California seniors and their families. Starting January...

New Medi-Cal Rules for 2026: What California Families Need to Know Before December 31, 2025

Major Medi-Cal changes are coming January 1, 2026 — and they could dramatically affect your eligibility for long-term care coverage. Here’s what you need to know to protect your assets and maintain benefits under the new rules. Key Changes to Medi-Cal Beginning...

2026 Medi-Cal Asset Rule Reinstatement: What You Need to Know

California’s Medi-Cal program is once again changing course. Beginning January 1, 2026, the state will reinstate asset limits for most older adults and individuals with disabilities applying for long-term care or other non-MAGI (non-Modified Adjusted Gross Income)...

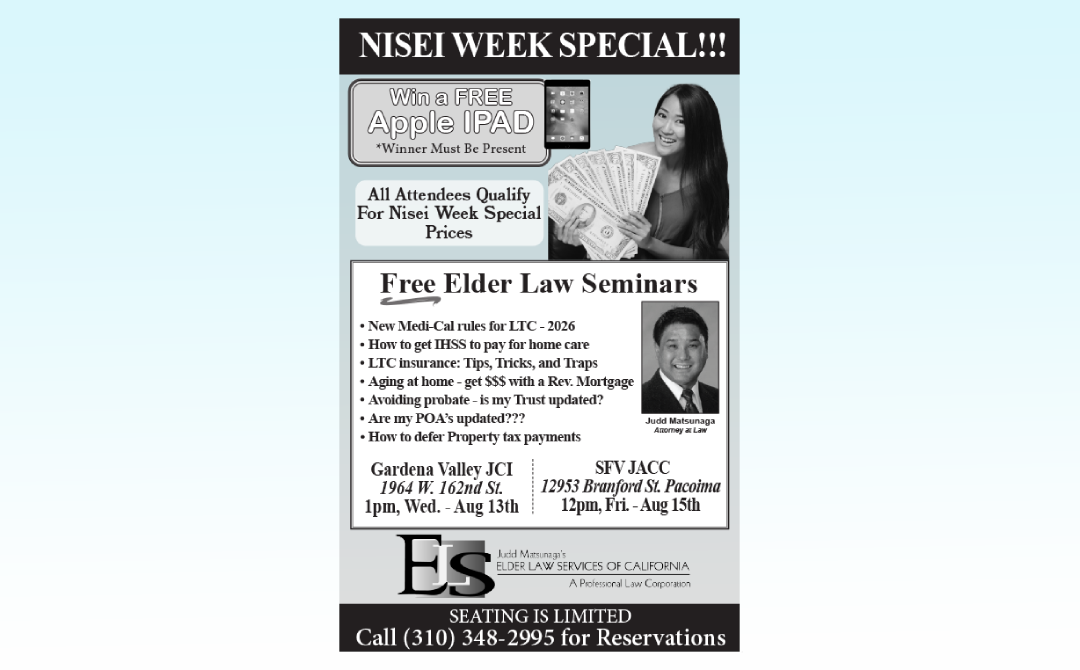

Free Elder Law Seminars During Nisei Week – Protect Your Future & Your Family

Seating is limited. Call now to reserve your spot: (310) 348-2995 Nisei Week is a time of celebration, community, and honoring the heritage of Japanese Americans. It’s also the perfect time to take steps to protect what matters most—your health, your home, and your...

How to Pay Fund Your Retirement

Unlock the Value of Your Home to Fund a Better Retirement Strapped for cash? With the cost of food, gas, and healthcare going up, you might be running out of savings sooner rather than later. However, if you own your own home, there’s some good news. You might be able...

Probate – A Legal Nightmare!

Why Probate Is a Legal and Financial Headache You Can Avoid The passing of a loved one is always a difficult and heartbreaking situation to endure. In addition to grieving the loss of a dear family member or friend, you must also begin to handle funeral arrangements,...

Benefits of a Living Trust

Why a Living Trust May Be the Smartest Move for Your Estate Do you (or your parents) need a living trust? The answer is “perhaps.” This article is to help you decide whether to make a living trust or not. Estate planning can sometimes feel overwhelming, but most...

Medi-Cal Income Limits 2025

Medi-Cal Income Limits for 2025: What You Need to Know Navigating the Medi-Cal system can feel overwhelming, especially when it comes to understanding income limits and eligibility requirements. If you or your loved ones are considering applying for Medi-Cal benefits...

Homeowners Insurance and Your Trust

Do You Have a Home that has been Titled into your Trust? If you've transferred your home's title or deed into your trust's name, it's crucial to inform your insurance agent to maintain proper coverage. Some insurance companies require notification of such changes to...

Welcome to the Elder Law California Blog—your trusted source for expert guidance on Estate Planning, Medi-Cal, Probate, Asset Protection, and more. Explore our latest posts for valuable insights that help you plan, protect, and preserve what matters most.